I had the chance to participate on a SMB Boston panel last week on Driving Business Value Through Social within Financial and Regulated Environments, which I think was just a fancy way of saying “social media in financial services.”

The main message of my presentation:

Financial institutions should integrate social media approaches into their marketing and customer service processes.

As I see it, banks (and credit unions) are wrestling with — or perhaps, simply failing to address — challenges regarding social media. And you don’t even need to be a journalist to know where these challenges came from:

- What: Banks don’t know what to say in social media.

- When: Banks don’t know when to say it.

- How: Banks don’t know how to say it.

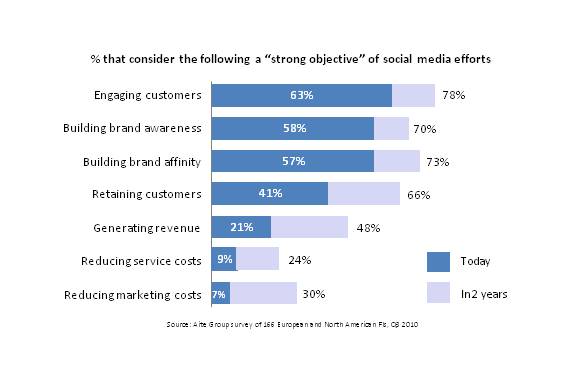

There are, of course, a couple of other potential challenges, but I think that “Who to say it to” is less of a challenge, and that “Why they’re saying it” is better understood. Regarding “why”, the research that Aite Group has done on social media in banking, bears this out: Most FIs are fairly clear that engaging customers, building brand awareness, and building brand affinity are why they’re involved with social media.

Engagement may be the objective, but I’m not sure, based on what I’ve seen FIs tweet and post, that they know how to achieve that objective.

I saw one FI recently tweet:

Have a new business that needs to grow quickly? Add credit card processing to increase revenues and cash flow. #smallbiz

Here’s another from a credit union:

We are listening. We are not like the BIG Banks. Check us out!

Do people really turn to Twitter or Facebook to see shameless marketing messages, re-purposed from other marketing channels? Are these tweets effectively engaging customers/members/prospects? I don’t know. But I bet the FIs that tweeted those messages don’t know either.

Another thing that struck me reading those tweets, was thinking about why the FIs chose to tweet those messages when they did. Was some marketing person sitting around with nothing to do, and suddenly realize that ts was 30 minutes since the last tweet, so s/he might as well tweet something else? Did something trigger the need for a credit card processing tweet at that particular time? I can tell you this: The credit union’s tweet came 11 days after Bank Transfer Day, so I doubt there was some pressing need to send out that tweet when it was sent.

The tone of these tweets doesn’t sit well with me, either. How many times have you heard the phrase “join the conversation?” Look again at those tweets above — do you know anybody who talks like that in the course of a normal conversation? (If you do, I bet you don’t engage in too many conversations with that person).

This gets at a big issue that marketers (not just in financial services) have to face: They don’t know how to have (or start) a conversation with consumers. Here’s the problem:

Marketing has, to date, been driven by the need and desire to persuade consumers.

But “engagement” isn’t accomplished through persuasion. (Well, persuasion can be a part of it, but it can’t be the only part of it).

———-

So what should FIs do to address these challenges? There’s a tactical response and a strategic response.

The tactical response: Categorize and test.

A couple of months ago, Michael Pace from Constant Contact wrote an interesting blog post, advocating that Twitter users should periodically do a self-analysis of their tweets. Honestly, I thought that was a pretty self-indulgent thing for an individual to do. But at the company level, the idea has a lot of merit.

A high-level analysis of your company’s Twitter stream can help you understand how well you’re balancing various types of tweets. And the same could be done with Facebook posts. The challenge, of course, is understanding what impact those messages are having, and if shaking up the mix would improve the impact (i.e., engagement).

———-

But even if you do this, I doubt that you’ll make more than just a minor impact on your firm’s bottom line. To have a more meaningful impact, you need the strategic response: Integrate social media approaches into marketing and customer service processes.

In my presentation at the breakfast, I highlighted three ways to do this:

1. Influence preferences. I like what America First Credit Union does on its site (as does @itsjustbrent, since he either borrowed this example from me, or I stole it from him). The CU incorporates members’ product reviews on the product pages. By doing this, the CU accomplishes:

- Customer advocacy. Not just in the net promoter sense of the word — but in the more important sense of the word: Doing what’s right for the customer and not just your own bottom line. Helping consumers make better choices — that are right for them — by enabling them to access other customers’ opinions is a demonstration of customer advocacy.

- Active engagement. I guess that, if a customer follows you on Twitter and reads your tweets, or likes you on Facebook in order to enter a contest to win a prize, you could call that engagement. But I would call it passive engagement. Customers who take the time to post a review are more actively engaged, in my book.

- Continuous market research. I doubt many firms could capture the richness of information America First is capturing through satisfaction or net promoter surveys. And I know that they can’t capture it in as timely a basis as America First does.

2. Provide collaborative support. I’ve been holding up Mint.com as an example of a firm with collaborative support, but it recently discontinued its Mint Answers page. No worries, Summit Credit Union is doing the same thing, and hopefully, they can become my poster child for this. Collaborative support is giving customers the opportunity to answer other customers’ questions. Dell has been doing it for years. Why provide collaborative support?

- Reduced call volume. I’m not going to say that you’re going to see a huge volume of deflected calls, but over time, if you market the collaborative capability, it can help.

- Expanded knowledge base. This is where the bigger value comes in. Customer service reps leverage internal knowledge bases to answer customer questions. Collaborative support helps grow that knowledge base, and helps figure out which answers and responses are more valuable than others. This expanded knowledge base will also prove valuable in training new employees.

- Active engagement. Similar to the product reviews, customers who participate in collaborative support sites are demonstrating active engagement.

3. Instill financial discipline. This is about using social concepts to get people to change the way they manage their financial lives. Take a look at the research that Peter Tufano has done regarding what motivates people to save. There are some good examples of this in practice — see Members Credit Union’s What Are You Saving For?. I recently chatted with the CEO of Bobber Interactive, and like what they’re doing about bringing social gamification to how people manage their finances.

———-

Bottom line: Your firm can putz around with Facebook and Twitter until you’re blue in the face. For financial institutions, this is probably not going to have much of an immediate impact on the bottom line. It will likely take years of experimentation to figure out what to say, when to say it, and how to say it on social media channels.

If you want to engage customers, you have to give them a reason to engage. Mindless, idle chatter on Twitter and Facebook isn’t sustainable.

The path to making social media an important contributor to bottom line improvement — and sooner rather than later — will come from integration social media concepts and approaches into everyday marketing and customer service processes.